Approach and Governance

Who we are > Governance

Approach and Governance

Who we are > Governance

Approach and Governance

Risk Philosophy

Yoma Bank’s risk philosophy is based on its commitment to be “The Responsible Bank” in Myanmar. Yoma Bank commits to achieving sustainable risk adjusted returns to support the development of the economy by enabling business growth and expanding access to financial services in target markets.

Risk Governance

Our Board of Directors is ultimately responsible for ensuring that the Bank’s activities are:

- aligned with the Bank’s long-term objectives.

- governed by an effective risk and control framework which enables all material risks to be identified, assessed and managed.

- carried out within the defined risk appetite of the Bank.

Through its four Committees, the Board ensures that the risk management framework and internal controls are effective:

- the Risk Oversight Committee approves risk appetite, risk management policies and oversees their implementation. It delegates responsibility to three sub-committees led by our Management Team: the Executive Credit Committee, the Asset-Liability Committee and the Product Committee.

- the Audit Committee monitors internal controls across the Bank and reviews their effectiveness through the Internal Audit.

- the People, Remuneration and Nomination Advisory Committee ensures proper oversight and guidance in relation to the Bank’s people and remuneration related strategies, policies, frameworks, and practices.

- the Technology Advisory Committee oversees the Bank’s technology strategy, significant investments in support of such strategy; and the Bank’s technology risk management, security framework and its effectiveness in conjunction with the Bank’s Risk Oversight Committee.

The Chief Executive Officer (CEO) and the Chief Risk Officer (CRO) are both responsible for ensuring implementation of the risk policies and procedures approved by the Board and Risk Management Oversight Committee across the Bank.

Executive Credit Committee (ECC)

The ECC’s mandate is to provide oversight of the Bank’s credit activities on behalf of the Board. The ECC is responsible for ensuring that suitable credit risk policies, underwriting standards, risk measurement and approval limits are developed and applied.

Credit approving authorities are delegated top down from the Board of Directors to ECC who in turn further delegate to various executive level credit approving officers for credit decision making.

The ECC shall ensure that the Bank’s Credit Risk Policy & Guidelines and Procedures are implemented and applied consistently across all business units and in compliance with regulatory requirements and internal policies applicable to credit, including any legal and credit appetite portfolio lending limits.

The ECC’s functions also include: a review of the credit strategy, review of portfolio quality trends and emerging credit risks, development of asset writing strategies according to changing strategy and external environments, and a review of credit products and programs prior to submission to the Risk Oversight Committee.

Asset-Liability Committee (ALCO)

The ALCO’s mandate is to ensure the implementation of the Asset-Liability Management (ALM) policy and oversight of the risks prescribed within it. ALM covers the following key functions and risks: capital adequacy, liquidity, interest rate risk, foreign exchange, and other market risks.

The ALCO has a key strategic role in managing the structure of the Bank’s balance sheet, determining pricing for all banking products, and ensuring that capital and liquidity are adequate to support the projected business growth plans and are in compliance with relevant regulations and standards, including all other related legal obligations and covenants that the Bank has.

The ALCO has enhanced the liquidity crisis management plan considering the Strategic Business Objectives, Regulatory Obligations, Shareholders’ Requirements, Bank’s Internal Risk KPIs and Control Environment and External Economic Trends and managed the Liquidity Risk through board approved liquidity crisis management plan.

Non-Performing Loan Committee (NPL)

NPL Committee’s mandate is to oversee and monitor product wise NPL movement, review specific accounts with high exposure and monitor appropriateness of provision and provision forecasts.

NPL Committee has strategic role in managing the Bank’s non-performing loans, approving necessary actions including legal and settlements and delegate appropriate authority to management for operational efficiency.

Product, Pricing and Delivery Committee

The Product Committee’s mandate is to ensure new products and services are developed in accordance with product policy, risk appetite and in response to market demands. The Committee also reviews product performance and considers necessary modifications to existing products including sunset clauses/actions.

Crisis Management Team

Crisis Management Team (“CMT”) is accountable for operational implementation of the Business Continuity Management (“BCM”) Policy as per Central Bank of Myanmar regulations.

Risk Management Framework

Enterprise Risk Management Policy has established to define the Bank’s Risk Management System and key policy requirements to ensure robust implementation of the system. At Yoma Bank, risk management is core to all banking activities and we aspire for the Bank’s risk management to be a competitive advantage in our mission to Build a Better Myanmar.

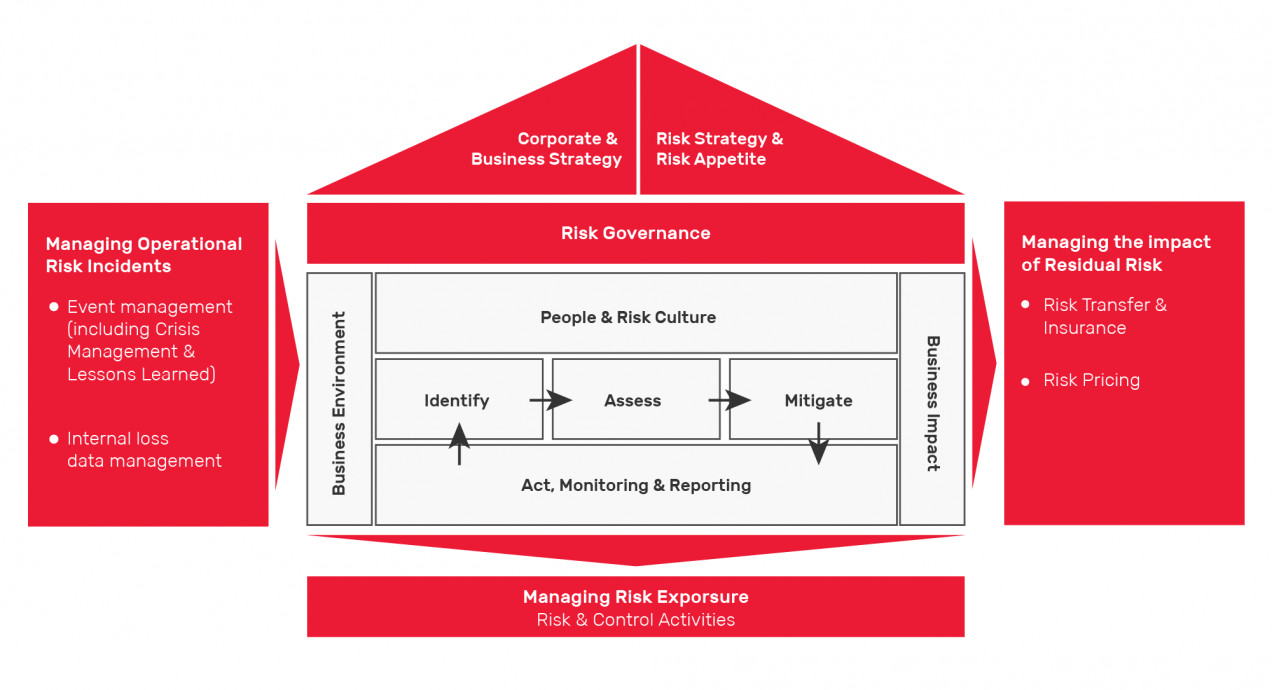

Under Yoma Bank’s Risk Management Framework, as shown in the following diagram, the Risk Management team together with the business and branch support units identify the respective risks, facilitate risk and control assessments. The Bank has enhanced the Fraud Management, Business Continuity Management and Environmental and Social Governance in current financial year.

- Yoma Bank has a fraud uplift plan that focuses on customer education and awareness, staff education and culture uplift to protect our customers, employees, and the bank. Yoma Bank also has a robust incident management framework and dedicated customer care center and social media engagement team to monitor, record and resolve customer complaints.

- Business Continuity Management is crucial in providing uninterrupted products and services to our customers. As part of Business Continuity Management, Yoma Bank has conducted a wide range of Business Continuity initiatives such as establishing Crisis Management Team, enhancing disaster recovery technology infrastructure, conducting emergency drill and tabletop exercises and trainings to ensure that there is no major interruption to the services.

- A tailor-made initial E&S risk assessment process has been enhanced and launched to assist the Business Team, as a first line of defense, in identifying the E&S risk related to their respective lending especially for the prospective business opportunities. This assessment process enhances not only the processing of E&S risk assessments but also the compliance to our E&S policy.

Risk Appetite Setting Process

Three Lines of Defense Model

| First Line of Defense Risk Management | Second Line of Defense Risk Oversight | Third Line of Defense Independent Assurance |

| Takes and manage risk exposure in accordance with the risk appetite, mandate and limits set by the Board | Ensures key risks are escalated to Board and provides oversight to ensure First Line business executed in line with the bank’s risk appetite | Provides the Board with an independent opinion about the effectiveness of Risk Management and Internal Controls |

| Identifies and escalates significant emerging issues related to risk | Develops the Risk Management Framework (policies, systems, processes, tools) | Confirms the level of compliance with regulations, and other limits and requirements as defined in the Bank’s policies |

You may also be interested in

Key risks

Risk of loss arising from any failure by a borrower or counterparty to meet its…

Explore Detail

BizSpace Portal

BizSpace Portal SMART Credit Business Portal

SMART Credit Business Portal Payroll Portal

Payroll Portal Supply Chain Financing

Supply Chain Financing HP Dealer Portal

HP Dealer Portal