Early Dawn Microfinance (DAWN) and Yoma Bank Signed a USD 10M Funding Agreement

1 Min Read

The Facility Enables Additional Lending to 30,000 Micro Entrepreneurs Across Myanmar

Yangon, Myanmar – May 30, 2018 – Yoma Bank and Early Dawn Microfinance Company Limited (DAWN) signed a USD 10M local currency equivalent (circa MMK 13.5B) funding agreement in support of DAWN’s microfinance operations in Myanmar. Yoma Bank is one of Myanmar’s largest banks with over 3,000 staff and 74 branches nationwide. DAWN currently services more than 155,000 micro entrepreneurs and small businesses out of 40 branches in Myanmar.

“This $10 million project between the U.S. government, Yoma Bank, and DAWN will help more people in Myanmar access loans so they can start new businesses, help keep their kids in school, and invest in farms,” U.S. Ambassador Scot Marciel said at the signing ceremony. The Overseas Private Investment Corporation (OPIC), part of the U.S. government, is working with Yoma Bank and DAWN to increase access to loans for all people in Myanmar.

The semi-collateralized funding agreement allows DAWN to fully hedge U.S. dollar funding USD 4M with 4 years tenor provided by the US-based Overseas Private Investment Corporation (OPIC), on the back of which a multiple of Myanmar Kyat is lent locally by Yoma Bank. This back-to-back structure was introduced by Yoma Bank mid-2017 and has since been servicing the rapidly growing microfinance sector. Yoma Bank was the first Myanmar bank to lend to MFIs on a semi-secured basis and has become the local lender of choice for the Myanmar microfinance community.

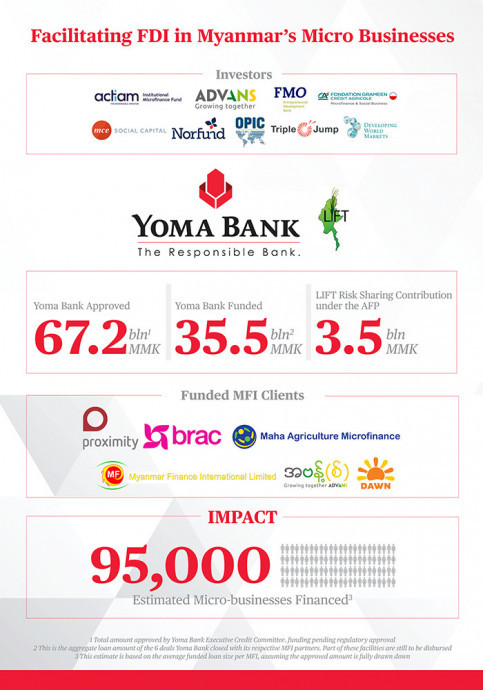

This is the sixth MFI funding agreement for Yoma Bank and it has a few more in the pipeline. “We are pleased to be able to facilitate additional foreign direct investment (FDI) into Myanmar’s microfinance industry, which is so important industry for financial inclusion. High quality microfinance institutions like Dawn are able to attract investment from OPIC, the United States’ development finance institution, and our wholesale finance product greatly enhances that impact,” said the Advisor to the Chairman and CEO of Yoma Bank, Mr. Hal Bosher, “What is most important is that, together, we can support Myanmar’s micro entrepreneurs,” Bosher added.

“This local currency funding enables DAWN to service an additional 30,000 micro entrepreneurs and small businesses across the country, with products and services based on client-centered design, aiming to implement in the near future a paperless-cashless operation, with the support of our shareholders Accion, FMO and Triodos”, expressed Gonzalo González A., DAWN´s CEO.

According to Teun van Vlerken, Credit Risk Consultant with Yoma Bank under the LIFT-supported Agribusiness Finance Programme, the bank’s risk appetite is driven by the quality and growth potential of the underlying business, rather than the traditional fixed collateral that can be pledged. “DAWN’s strong management, reputable investors, and operational excellence have strongly contributed to our decision to back their business with a substantial debt investment.”